Wealth Management Strategies

In today’s fast-changing financial world, effective wealth management is more important than ever. Whether you’re planning for retirement, growing your investments, or preserving your legacy, the right wealth management strategies can help you achieve long-term financial security.

What Is Wealth Management?

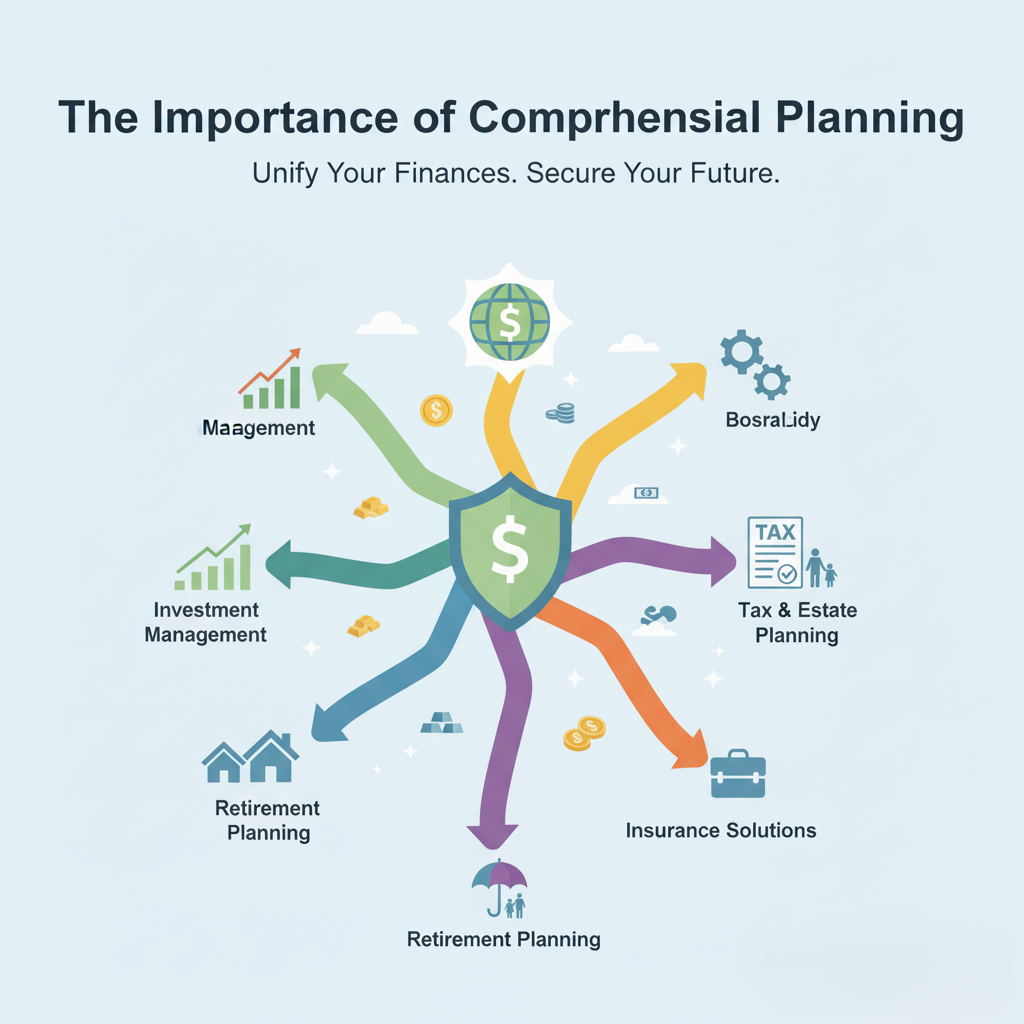

Wealth management is a comprehensive financial planning approach that combines investment management, retirement planning, tax strategies, estate planning, and insurance solutions. It goes beyond simply investing — it creates a roadmap for your entire financial future.

Key Wealth Management Tips for Long-Term Success

1. Set Clear Financial Goals

Define your short-term and long-term financial goals. This gives you a clear direction for your investments and planning.

2. Diversify Your Investments

Diversification reduces risk. A well-balanced portfolio across stocks, bonds, real estate, gold, and even crypto can protect your wealth in volatile markets.

3. Plan for Retirement Early

The sooner you start saving and investing for retirement, the more your money benefits from compound growth. Retirement planning is a cornerstone of wealth management.

4. Minimize Taxes with Smart Planning

Tax-efficient investment strategies, retirement account contributions, and estate planning can help reduce your tax burden and preserve more of your wealth.

5. Protect Your Wealth with Insurance

Insurance is not just protection — it’s risk management. Life, disability, and long-term care insurance safeguard your financial plan against the unexpected.

6. Review and Update Your Plan Regularly

Life changes, markets shift, and laws evolve. Regular reviews with a financial advisor keep your plan aligned with your goals.

Why Professional Wealth Management Matters

While DIY investing can work in some cases, comprehensive wealth management services provide expertise, discipline, and holistic strategies that individuals often overlook. A trusted advisor helps you integrate investment planning, retirement strategies, tax efficiency, and estate planning into one seamless plan.

Final Thoughts

Strong wealth management is about more than building wealth — it’s about protecting, growing, and transferring it with confidence. By following these wealth management tips and working with an experienced financial advisor, you can achieve financial clarity and long-term security.

At Swift Peak, we provide customized strategies to help clients reach their goals and build lasting financial freedom.

swiftpeakpl@gmail.com

Related Posts

Smart Retirement Planning

Smart Retirement Planning Retirement is one of life’s biggest milestones, and preparing for it goes far beyond saving money. A smart retirement plan ensures that…

Read More

Why Financial Planning Matters

The Importance of Comprehensive Financial Planning in Today’s World In a rapidly changing financial landscape, building and protecting wealth requires more than just choosing the…

Read More