Swift Peak

Helping you grow, protect, and transfer your wealth

Independent wealth management for families, business owners and institutions — investment strategies, financial & tax-aware planning, and legacy solutions tailored to your goals.

Empowering Business The Excellence

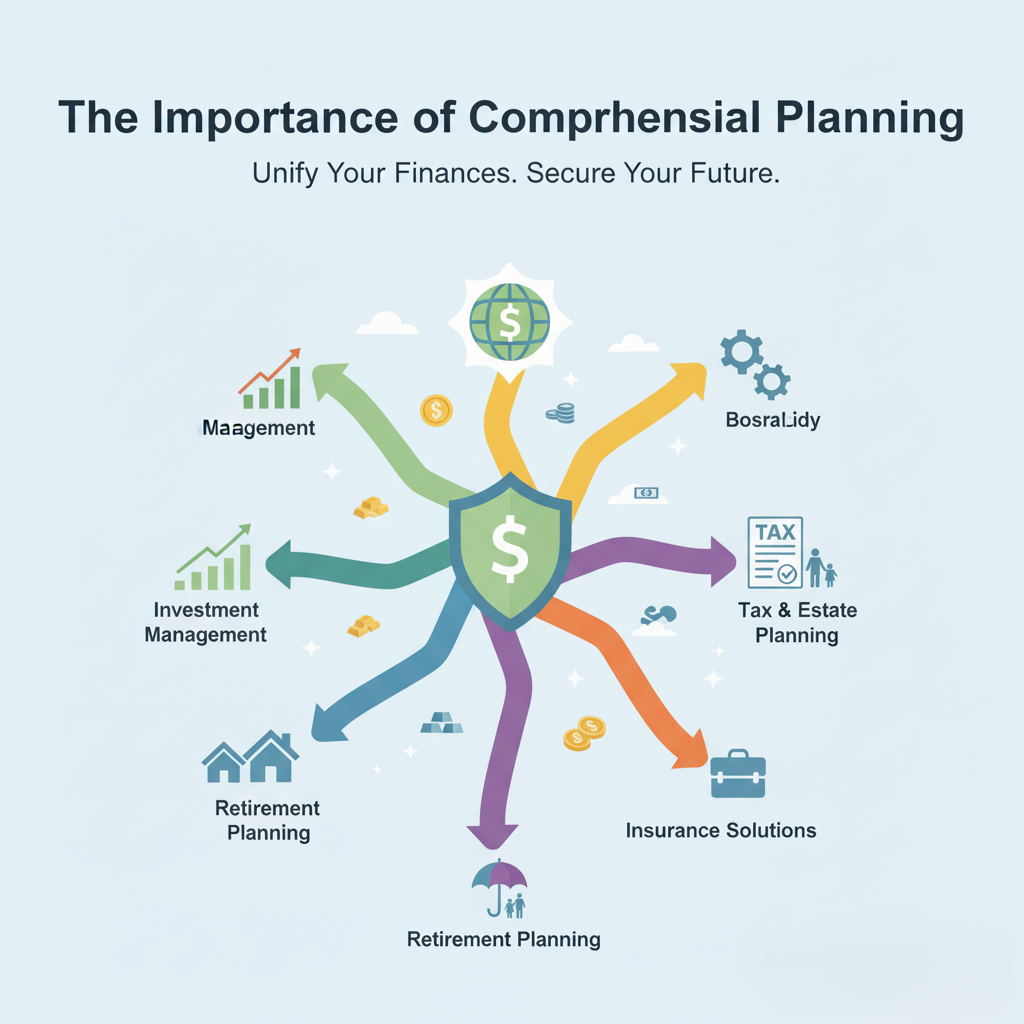

Investment Management

Many desktop publishing packages web page editors now use Lorem Ipsum a default model text, and a search

Read More

Financial Planning

Many desktop publishing packages web page editors now use Lorem Ipsum a default model text, and a search

Read More

Retirement Planning

Many desktop publishing packages web page editors now use Lorem Ipsum a default model text, and a search

Read More

Tax & Estate Planning

Many desktop publishing packages web page editors now use Lorem Ipsum a default model text, and a search

Read MoreDisclaimer!

All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. Nothing on this website should be considered a solicitation to buy or sell securities.

12k+

Worldwide clientsA Trusted Partner for Your Financial Journey

We combine expertise, integrity, and a client-first approach to deliver solutions that go beyond numbers — helping you achieve clarity, confidence, and peace of mind in managing your wealth.

Fiduciary Commitment

Always act in your best interest — no hidden agendas or product-driven sales.

Personalize Strategies

Every plan is tailored to your unique circumstances and aspirations. We care for our clients in an unique way.

Co - Expertise

Integrated approach covering investments, retirement, tax, estate, insurance.

Financial Peace

We provide unbiased, transparent advice as a legally committed Fiduciary, prioritizing your best interest.

Multi-Discipline Team

Benefit from a team of CFP®s and specialists ensuring expert, complete oversight.

Proven Client Trust

Join 12,000+ satisfied clients who trust our disciplined, results-driven approach.

Trusted & Personalized guidance

We build long-term relationships grounded in deep investment experience, independent advice and practical planning. Whether you’re an entrepreneur preparing for succession, a family preserving multi-generational wealth, or an institution seeking disciplined investment oversight — we design strategies that match your priorities, risk tolerance and tax situation.

Independent, fiduciary-first advice with transparent fees.

Multi-disciplinary team: investment managers, CFP®s, tax advisors, estate specialists.

Customized plans with ongoing monitoring and clear performance reporting.

Straightforward Collaborative Repeatable

01

Discovery

02

Planning

03

Implementation

04

Monitoring

Your Business Goals a Confidence

A multi-owner business faced a complicated exit. We developed a phased liquidity strategy, coordinated tax planning, and executed an owner transition that preserved value and supported family goals.

Business Owner Succession

The Ozwald Company

A couple nearing retirement sought predictable income with growth potential. We structured a diversified income portfolio and Social Security timing plan that reduced longevity risk and increased after-tax cash flow.

Retirement Income Design

Afterlife Homes

Innovation Moves You Forward

We operate on a transparent fee structure. Most of our clients pay an assets under management (AUM) fee, while some planning engagements may have fixed or hourly fees. We do not earn commissions from products or investments, ensuring advice is always in your best interest.

Our services are tailored for clients with significant investable assets. Minimums vary depending on the type of service. We encourage you to contact us to discuss your individual situation.

Yes. As fiduciaries, we are legally and ethically required to act in your best interest at all times. Every recommendation and strategy is designed with your goals in mind.

We typically schedule quarterly or semiannual reviews, with additional meetings as needed. Our team is also available for ad-hoc discussions when significant life events or market changes occur.

Client privacy and data security are top priorities. We use industry-standard encryption, secure document-sharing systems, and strict internal policies to safeguard all information.

We specialize in working with:

High-net-worth individuals

Families

Business owners

Institutions

Our clients value disciplined, long-term planning and professional guidance.

Our FAQ page is designed to provide clarity on common questions about our services, process, and engagement. All answers are crafted in a professional, client-friendly manner.

20+

Team members

1000+

Top project

98%

Client Satisfaction

90+

Client Review