Smart Retirement Planning

Retirement is one of life’s biggest milestones, and preparing for it goes far beyond saving money. A smart retirement plan ensures that your wealth not only lasts but also supports the lifestyle you envision.

Why Retirement Planning Is Essential

Without proper planning, many retirees face challenges such as:

Running out of savings too soon.

Unexpected healthcare and long-term care costs.

Rising inflation eroding purchasing power.

Complex tax obligations on retirement income.

Key Strategies for a Secure Retirement

1. Start Early

The earlier you begin, the more time your investments have to grow and compound.

2. Diversify Your Income Sources

Relying solely on one income stream is risky. Combining pensions, Social Security, retirement accounts, and investments creates stability.

3. Plan for Healthcare

Medical expenses are often underestimated. Incorporating healthcare and long-term care planning is critical for peace of mind.

4. Be Tax-Smart

Withdrawal strategies, Roth conversions, and tax-efficient investments can make a significant difference in preserving wealth.

5. Revisit Your Plan Regularly

Life changes, markets shift, and goals evolve. Regular reviews help ensure your retirement plan stays aligned with your needs.

Final Thoughts

Retirement should be a time of freedom and fulfillment, not financial worry. By creating a smart, flexible, and tax-efficient retirement plan, you can enjoy this chapter of life with confidence.

At Swift Peak, we specialize in designing retirement strategies that balance income, security, and legacy — so you can focus on what matters most.

swiftpeakpl@gmail.com

Related Posts

Wealth Management Strategies

Wealth Management Strategies In today’s fast-changing financial world, effective wealth management is more important than ever. Whether you’re planning for retirement, growing your investments, or…

Read More

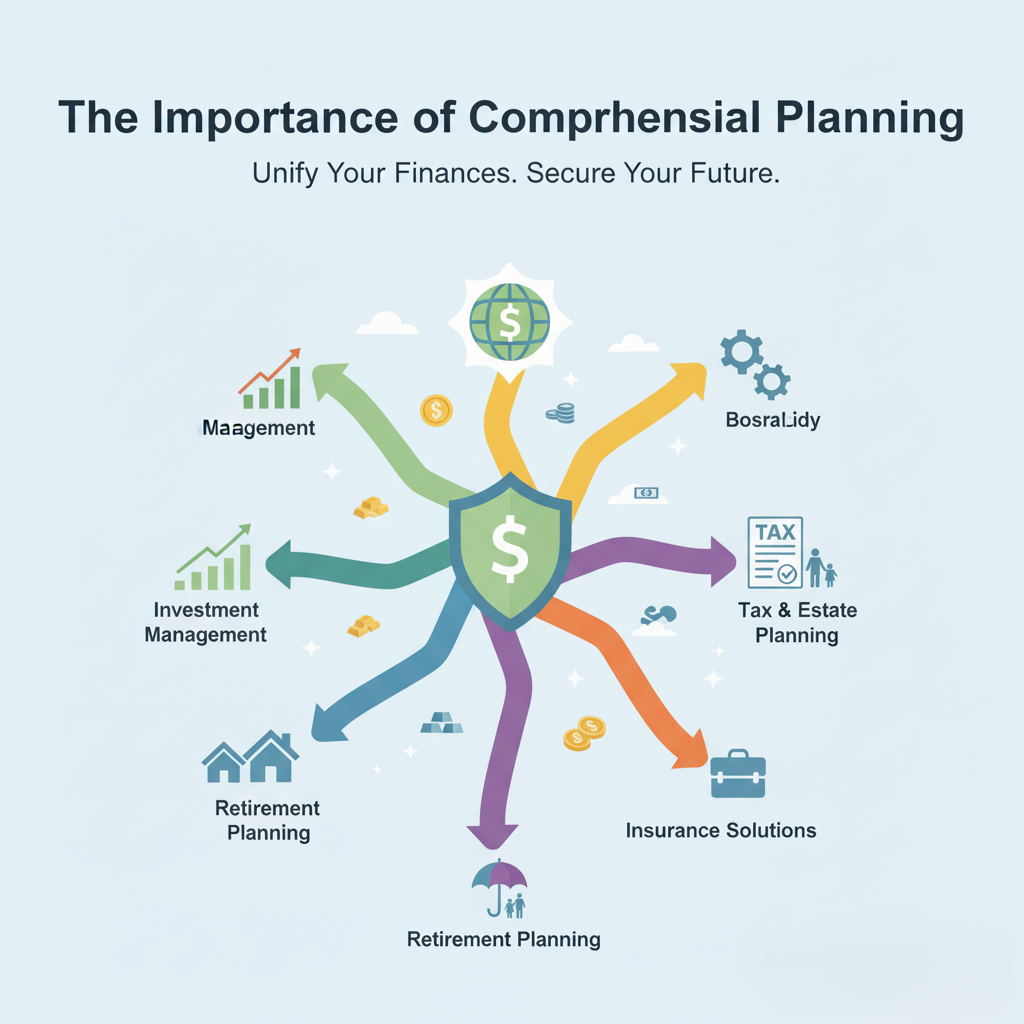

Why Financial Planning Matters

The Importance of Comprehensive Financial Planning in Today’s World In a rapidly changing financial landscape, building and protecting wealth requires more than just choosing the…

Read More