The Importance of Comprehensive Financial Planning in Today’s World

In a rapidly changing financial landscape, building and protecting wealth requires more than just choosing the right investments. True financial success comes from a comprehensive plan — one that integrates every aspect of your financial life and adapts as your circumstances evolve.

Why Financial Planning Matters

Financial planning is about more than numbers on a balance sheet. It’s about creating a roadmap that helps you:

Clarify your short-term and long-term goals.

Prepare for life’s uncertainties.

Balance wealth growth with protection.

Ensure your resources support your lifestyle and legacy.

Without a plan, even high-income earners risk missing opportunities, paying unnecessary taxes, or leaving loved ones unprotected.

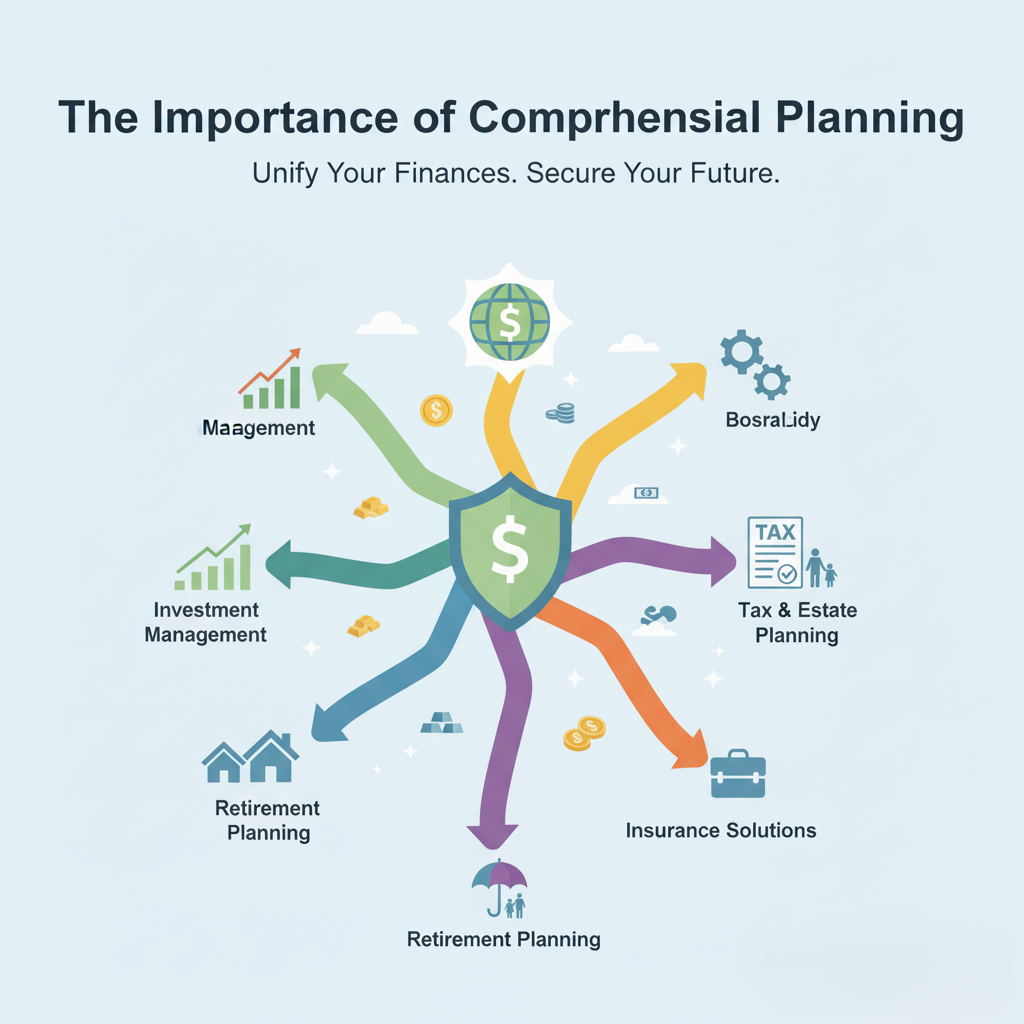

Key Elements of a Strong Financial Plan

1. Investment Management

A diversified, risk-managed portfolio that aligns with your goals and time horizon.

2. Retirement Planning

Creating reliable income strategies so you can retire with confidence and security.

3. Tax & Estate Planning

Minimizing tax liabilities and ensuring your wealth transfers smoothly to the next generation.

4. Insurance Solutions

Protecting your family and assets against unforeseen events such as illness, disability, or loss.

5. Business Succession Planning

Helping business owners prepare for smooth ownership transitions and preserve company value.

The Value of Professional Guidance

Many individuals attempt to manage finances on their own, only to find the complexity overwhelming. Regulations, tax codes, and market fluctuations require constant attention. By working with a trusted wealth management partner, you gain:

Objective advice tailored to your situation.

A disciplined process for decision-making.

A long-term partner committed to your success.

Final Thoughts

Financial planning is not a one-time event — it’s an ongoing journey. As your life changes, so do your goals, priorities, and risks. With the right plan in place, you can face the future with clarity, confidence, and peace of mind.

At Swift Peak, we are committed to helping clients navigate this journey by offering comprehensive, personalized strategies that support every stage of life.

swiftpeakpl@gmail.com

Related Posts

Wealth Management Strategies

Wealth Management Strategies In today’s fast-changing financial world, effective wealth management is more important than ever. Whether you’re planning for retirement, growing your investments, or…

Read More

Smart Retirement Planning

Smart Retirement Planning Retirement is one of life’s biggest milestones, and preparing for it goes far beyond saving money. A smart retirement plan ensures that…

Read More